library(readxl)

library(tidyverse)

library(forecast)

library(tseries)

library(ggTimeSeries)

library(data.table)

library(here)Modelling CPI Using ARIMA(p,d,q)

1) Why CPI is Time Series

Consumer Price Index (CPI) is defined as a measure of the weighted aggregate change in retail prices paid by consumers for a given basket of goods and services.

The CPI is a statistical indicator of changes in consumer prices experienced by citizens of a country. It is a measure that compares the cost of a fixed basket (234 items) of goods and services purchased by consumers over time. The CPI index reflects only pure price change and is a widely used to monitor the rate of inflation, which is the percentage change of CPI over one year (The Kenya National Bureau of Statistics (KNBS), 2010).

CPI is a univariate non-stationary time series variable which does not have significant seasonality. Univariate because it is a single variable that predicts (or correlates to) itself based on its own history (auto-regressive) as opposed to an ordinary regression variable that is predicted by one or more variables of different nature. Furthermore, CPI is a time series variable since observed values are indexed in time. The fact that it naturally has an upward trend, possibly due to increasing population, changing lifestyles of people, and a generally growing economy means it is not stationary. Another important characteristic of CPI is periodicity. That is, observations are made more than once a year, in this case twelve times per year. This shows that CPIs are monthly realizations of onward (monotone increasing) right-continuous random variable in positive real line.

The data I will be using is obtained from KNBS and runs from March 1962 to September 2020.

2) Loading the Required Packages

The following packages are required to perform this modelling; -

3) Loading Data

# import data

CPI_Data <- read_excel(here("./Data/Historical CPI series 2020.xlsx"))

# view data

head(CPI_Data, 10)# A tibble: 10 × 3

`MONTHLY CPI FROM 1962` ...2 ...3

<chr> <chr> <chr>

1 <NA> <NA> <NA>

2 Year Month Index

3 1962 Mar 0.47503449374032269

4 <NA> Jun 0.48014239152247667

5 <NA> Sep 0.48525028930463066

6 <NA> Dec 0.49035818708678469

7 1963 Mar 0.48525028930463066

8 <NA> Jun 0.49035818708678469

9 <NA> Sep 0.50057398265109265

10 <NA> Dec 0.50568188043324669The column names are in row 2, this can be corrected as;

# assign headers

colnames(CPI_Data) <- CPI_Data[2, ]

# drop records when Month is blank or has the string "Month"

CPI_Data_clean <- CPI_Data %>%

filter(!is.na(Month) & Month != "Month")

# fill in blank years

CPI_Data_clean <- CPI_Data_clean %>%

fill(Year, .direction = "down") %>%

mutate(Index = as.numeric(Index),

Year = as.numeric(Year))

# view data

head(CPI_Data_clean, 10)# A tibble: 10 × 3

Year Month Index

<dbl> <chr> <dbl>

1 1962 Mar 0.475

2 1962 Jun 0.480

3 1962 Sep 0.485

4 1962 Dec 0.490

5 1963 Mar 0.485

6 1963 Jun 0.490

7 1963 Sep 0.501

8 1963 Dec 0.506

9 1964 Mar 0.501

10 1964 Jun 0.5014) Declaring CPI as Time Series

CPI_Data_ts <- CPI_Data_clean %>%

select(Year, Month, Index) %>%

ts(start = c(1962, 3),

end = c(2020,9),

frequency = 1)

class(CPI_Data_ts) # Check the class, technically this is a univariate ts[1] "mts" "ts" "matrix" "array" 5) Visualisation of Trend

CPI_Data_clean %>%

# filter(Year < 1984) %>%

# mutate(Index = round(as.numeric(Index))) %>%

ggplot(aes(x = Year, y = Index, colour = "Data")) +

geom_line(size = 0.5) +

geom_smooth(aes(color = "Trend"),

method = "gam",

size = 0.5,

lty = 2) +

scale_colour_manual(values = c("dodgerblue1", "maroon")) +

scale_x_continuous(breaks = seq(1960, 2020, 5)) +

scale_y_continuous(breaks = seq(0, 110, 15)) +

labs(x = "Year",

y = "CPI",

title = "CPI & It's Trend, 1962 to 2020",

subtitle = "The Trend is Approximated using GAM",

caption = "Figure 1") +

# custom theme

theme(plot.title = element_text(face = "bold",

hjust = 0.5,

size = 13.5,

family = "serif",

color = "black"),

plot.subtitle = element_text(face = "italic",

hjust = 0.5,

size = 9.5,

family = "serif",

color = "black"),

axis.title = element_text(face = "bold",

size = 11.5,

family = "serif",

color = "black"),

axis.text = element_text(face = "plain",

size = 10,

family = "serif",

color = "black"),

strip.text.x = element_text(face = "bold",

size = 13.5,

family = "serif",

color = "black"),

axis.text.x = element_text(angle = 0,

hjust = 1),

legend.position = "top",

legend.title = element_blank(),

legend.text = element_text(face = "plain",

size = 10,

family = "serif",

color = "black"),

legend.key = element_rect(colour = NA,

fill = NA),

legend.box = "horizontal",

legend.key.size = unit(0.5, 'cm'),

legend.spacing.x = unit(0.3, 'cm'),

legend.background = element_blank(),

plot.background = element_rect(fill = "white",

color = "black",

linewidth = 1),

panel.grid = element_blank(),

panel.grid.minor.x = element_blank(),

panel.grid.major.x = element_blank(),

axis.line = element_line(color = "black"),

axis.ticks = element_line(color = "black"),

panel.background = element_blank()) +

guides(color = guide_legend(override.aes = list(fill = NA)))

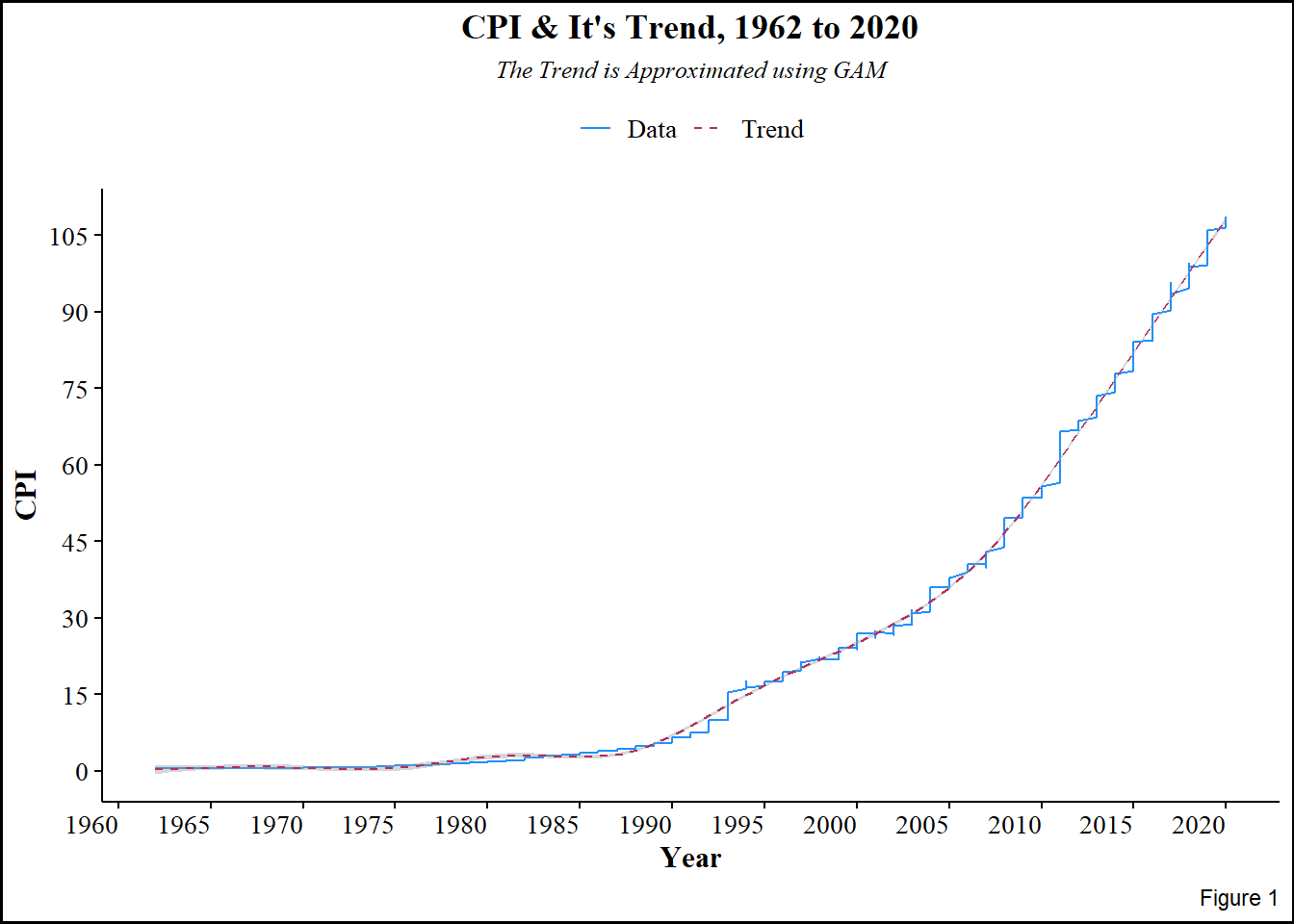

Figure 1 above shows upward rise in CPI over the years, the upwardness is indicative of trend, and therefore non-stationarity. This further implies that the CPI is constituted by multiplicative components; trend, seasonality, and random effects. Since it is multiplicative, applying log-transformation makes it easy to extract the random component by differencing, which also stabilizes variance and reduces seasonality. Even though the plot is ragged, seasonality is not immediately evident.

To extract seasonality, Seasonal Trend Loess decomposer (tslm()) is invoked. The decomposer, which works better than decompose(), is used for periodic time series, the periodicity (seasonal window) here is 4 months.

6) Decomposition of CPI

CPI_Data <- ts(CPI_Data_clean$Index, start = c(1962, 3), end = c(2020, 9), frequency = 4)

decompose_df <- tslm(CPI_Data ~ trend + fourier(CPI_Data, 2))

trend <- coef(decompose_df)[1] + coef(decompose_df)['trend']*seq_along(CPI_Data)

components <- cbind(

data = CPI_Data,

trend = trend,

season = CPI_Data - trend - residuals(decompose_df),

remainder = residuals(decompose_df))

autoplot(components, facet = TRUE)

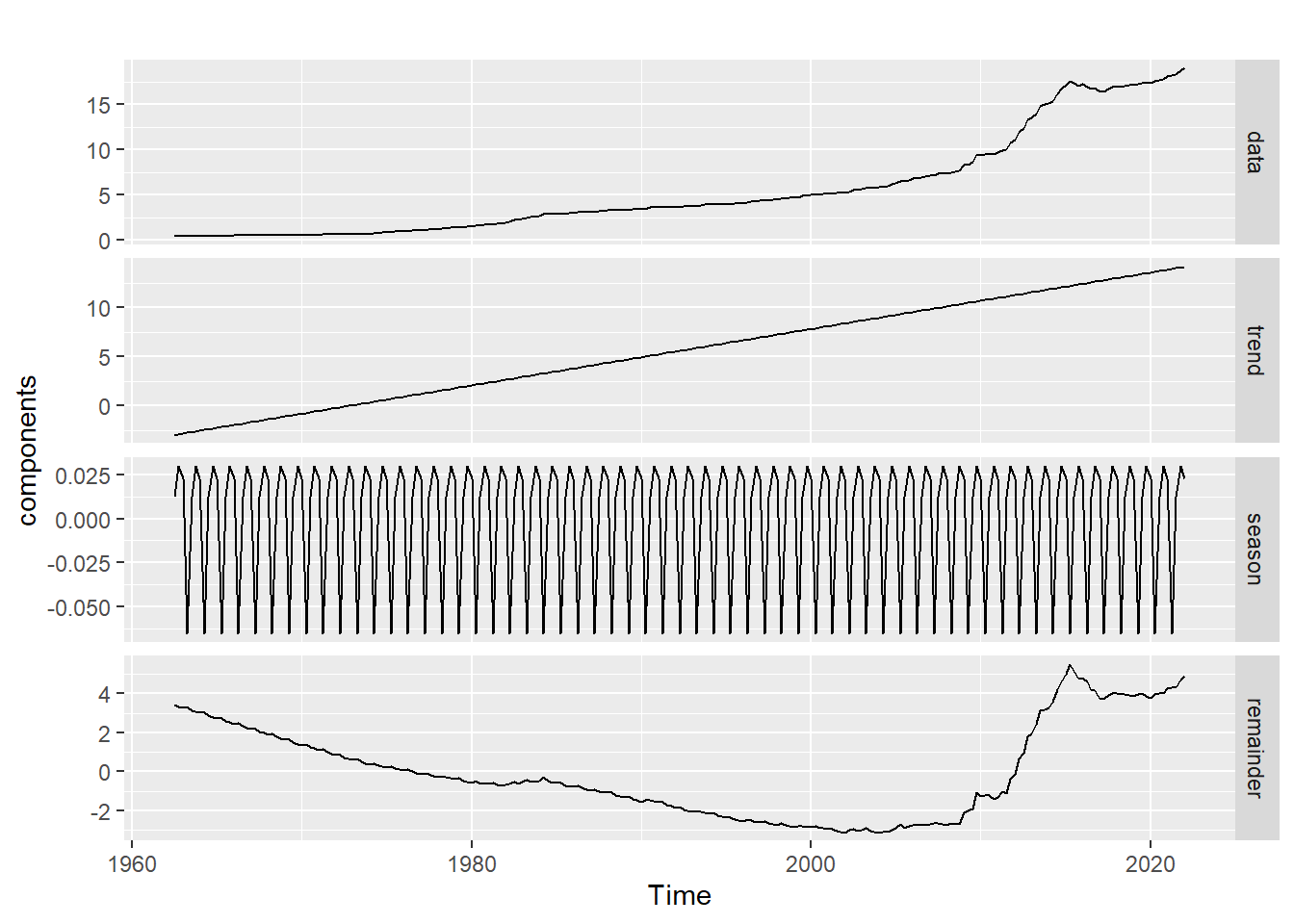

The plot above shows the individual components of CPI;

- Trend,

- Seasonality, and

- Random error.

Here, seasonal fluctuations are more evident. The trend has been smoothed, i.e. it is devoid of seasonality and random error. To explore seasonality:-

adjust_df <- CPI_Data - components[, 'season']

autoplot(CPI_Data, series = "Data") +

autolayer(adjust_df, series = "Seasonally adjusted")

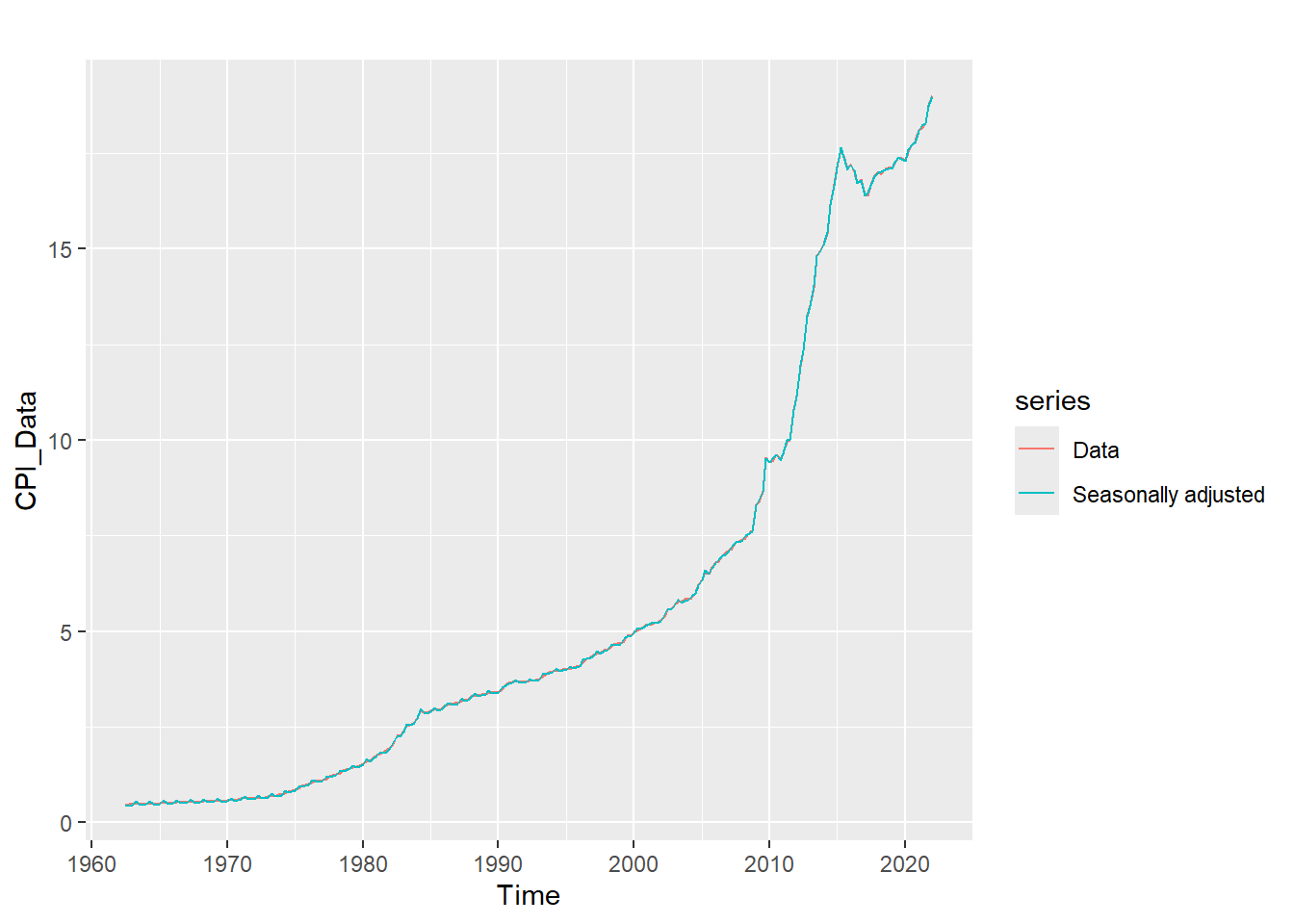

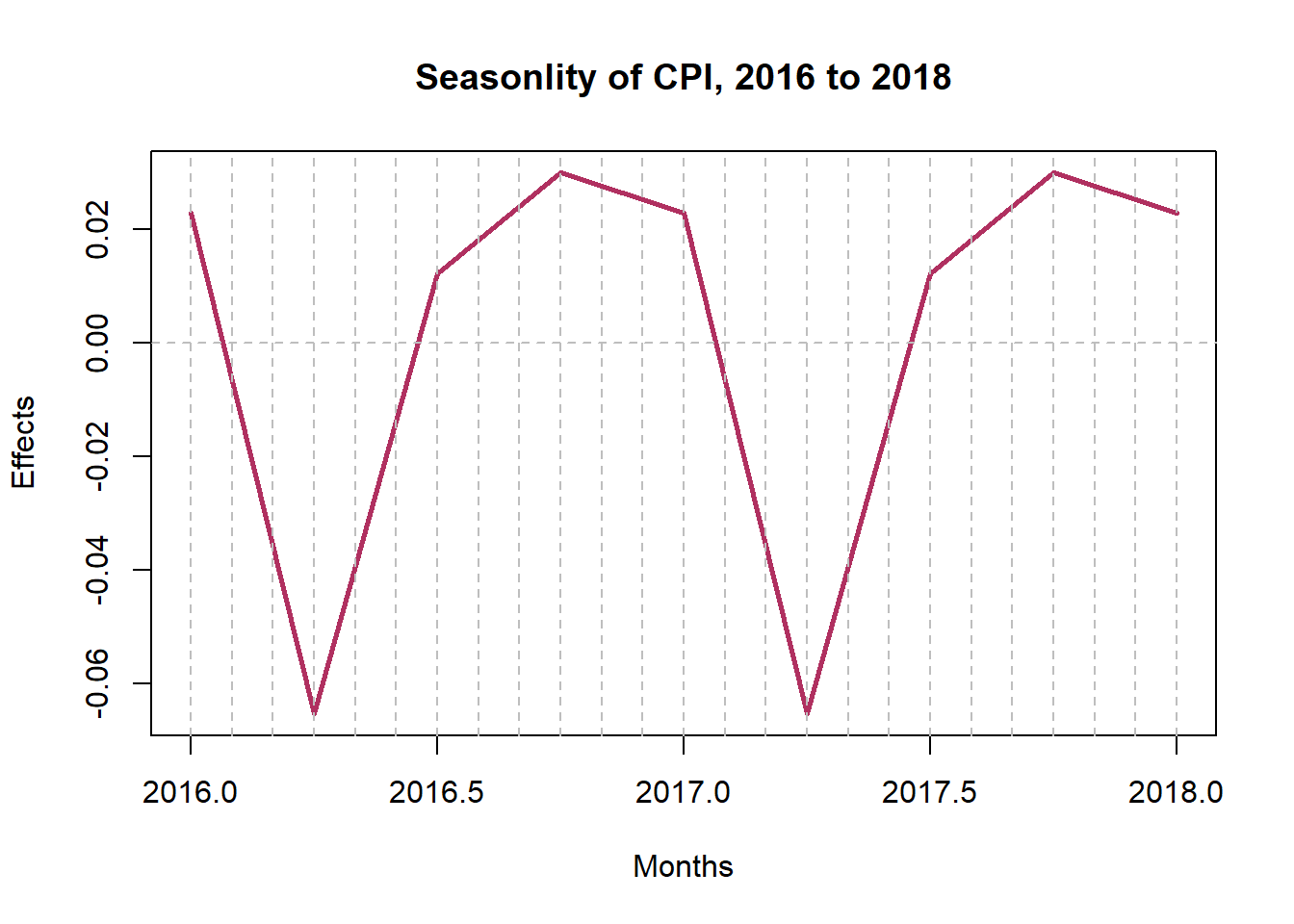

It is evident that the rate of consumption exponentially rose in the early ’80s to early ’90s. The sinusoidal aspect of seasonality is revealed by the plot below. Consumption goes down in April by a seasonal effect of 0.25 and goes up around July by an effect of 0.65 every year.

plot(window(components[,3],

start = c(2016,1),

end = c(2018,1)),

main = "Seasonlity of CPI, 2016 to 2018",

xlab = "Months",

ylab = "Effects",

col = "maroon",

lwd = 2.5)

abline(h = seq(-.7,.7,.1),

v = seq(2016, 2018, 1/12),

col = "grey",

lty = 2)

7) Checking Normality Pictorially

i) Stem and Leaf Plot

stem(CPI_Data, scale = 1, width = 105)

The decimal point is at the |

0 | 5555555555555555555556666666666666666666677777788899

1 | 00001111223344445556678889

2 | 00334566899999

3 | 0011111222333444444567777777778899

4 | 000000111233444556777799

5 | 001122223466788899

6 | 02455788

7 | 0012344466

8 | 347

9 | 4555679

10 | 08

11 | 19

12 | 3

13 | 35

14 | 08

15 | 014

16 | 244777899

17 | 00111112234445678

18 | 1238

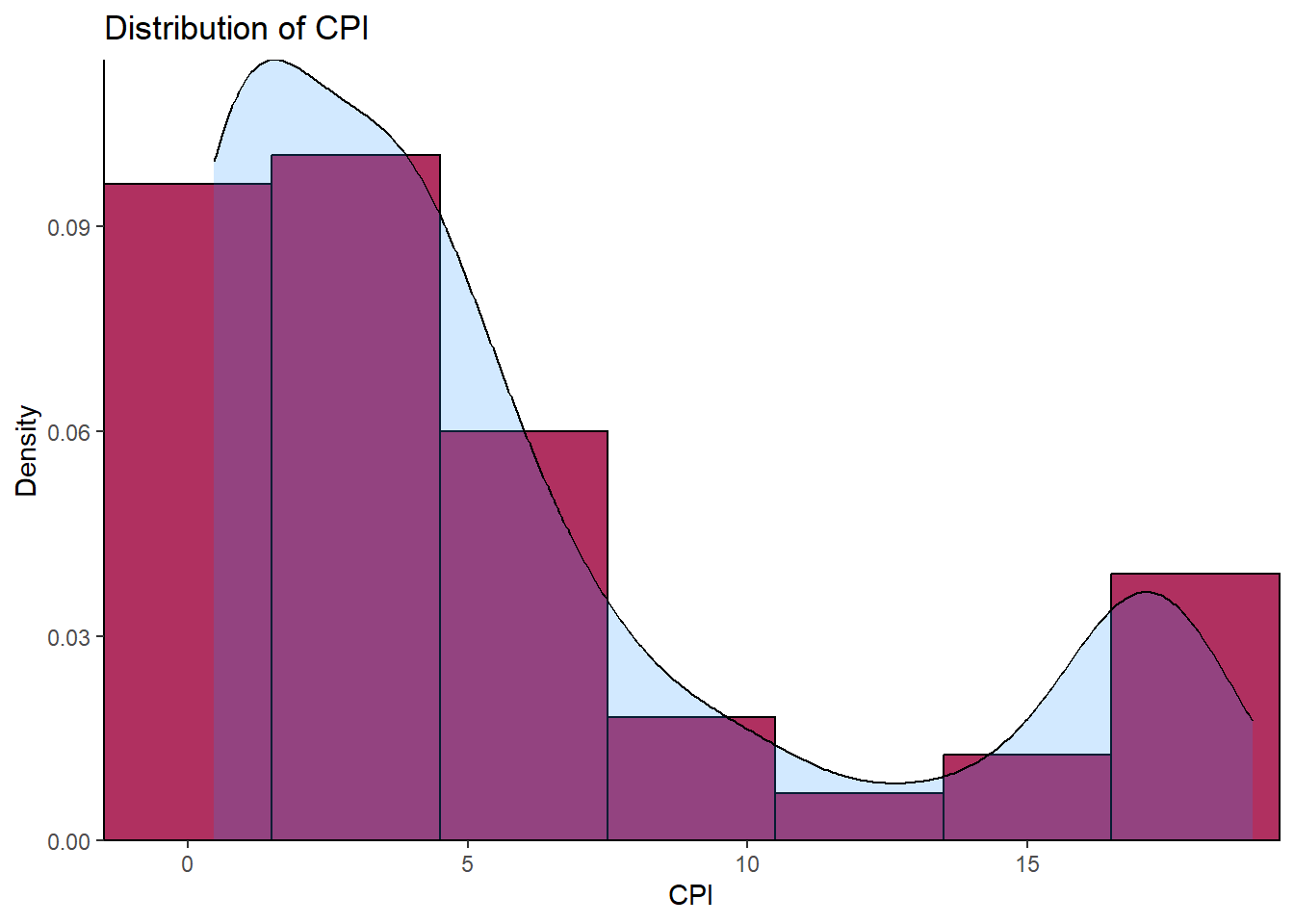

19 | 0The above stem-and-leaf diagram shows the skewed distribution that CPI assumes. The skewness is to right.

ii) Histogram

The histogram in the figure below is skewed to the right, confirming what we found with the stem-and-leaf diagram. This skewness implies the data is not normally distributed. Furthermore, the skewness calls for log-transformation of the data.

ggplot(CPI_Data, aes(x = CPI_Data)) +

geom_histogram(aes(y = after_stat(density)),

binwidth = 3,

colour = "black",

fill = "maroon")+

geom_density(alpha = .2,

fill = "dodgerblue1")+

labs(title = "Distribution of CPI",

x = "CPI",

y = "Density")+

scale_y_continuous(expand = c(0,0))+

scale_x_continuous(expand = c(0,0))+

theme_classic()

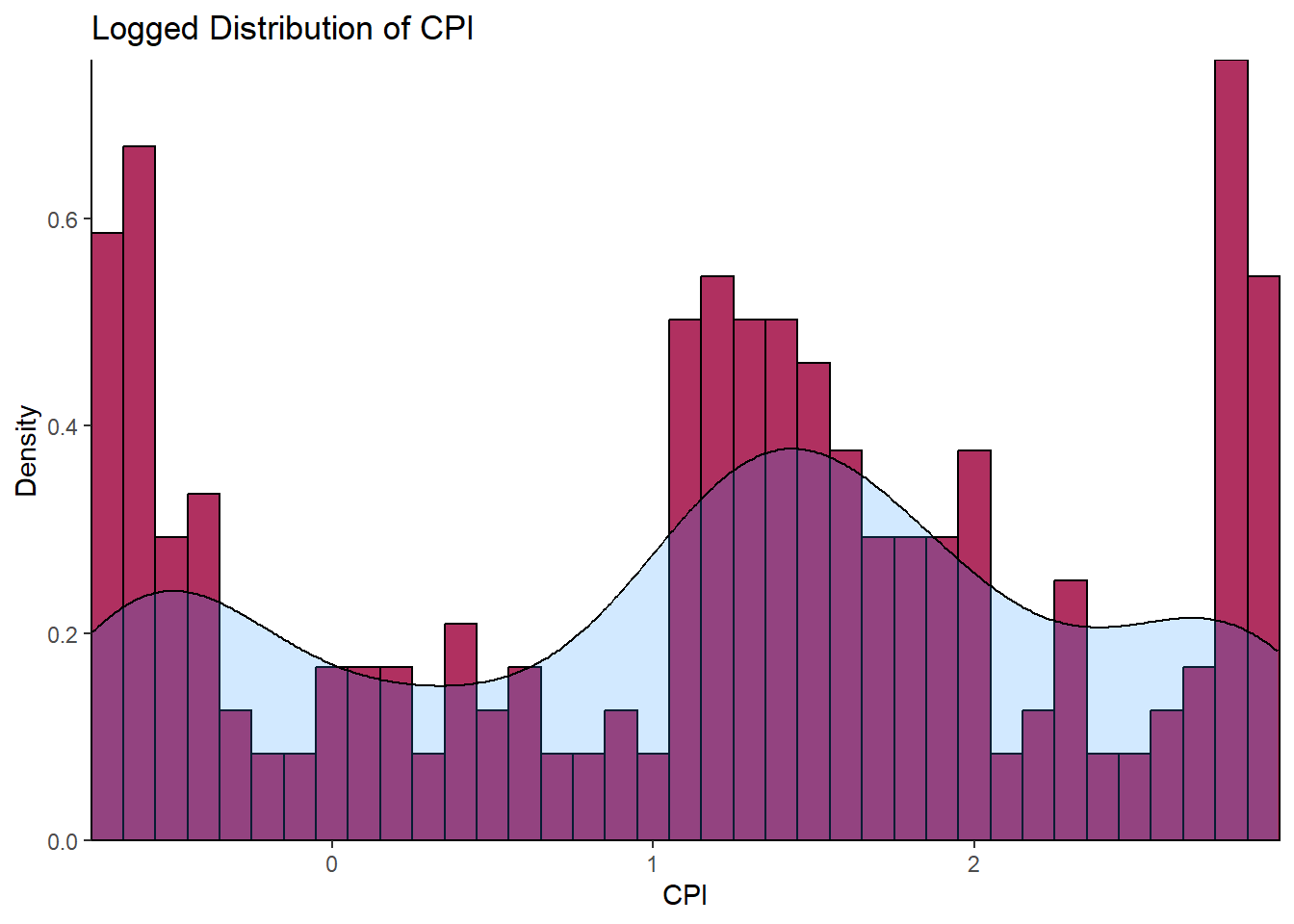

Histogram of Log Transformed CPI

LoggedCPI <- CPI_Data %>% log()

ggplot(LoggedCPI, aes(x = LoggedCPI)) +

geom_histogram(aes(y = ..density..),

binwidth = 0.1,

colour = "black",

fill = "maroon")+

geom_density(alpha = .2,

fill = "dodgerblue1")+

labs(title = "Logged Distribution of CPI",

x = "CPI",

y = "Density")+

scale_y_continuous(expand = c(0,0))+

scale_x_continuous(expand = c(0,0))+

theme_classic()

The histogram above with a superimposed kernel density plot for CPI log-transgeomed gives a vague hint of a bimodal distribution. This needs further transformation.

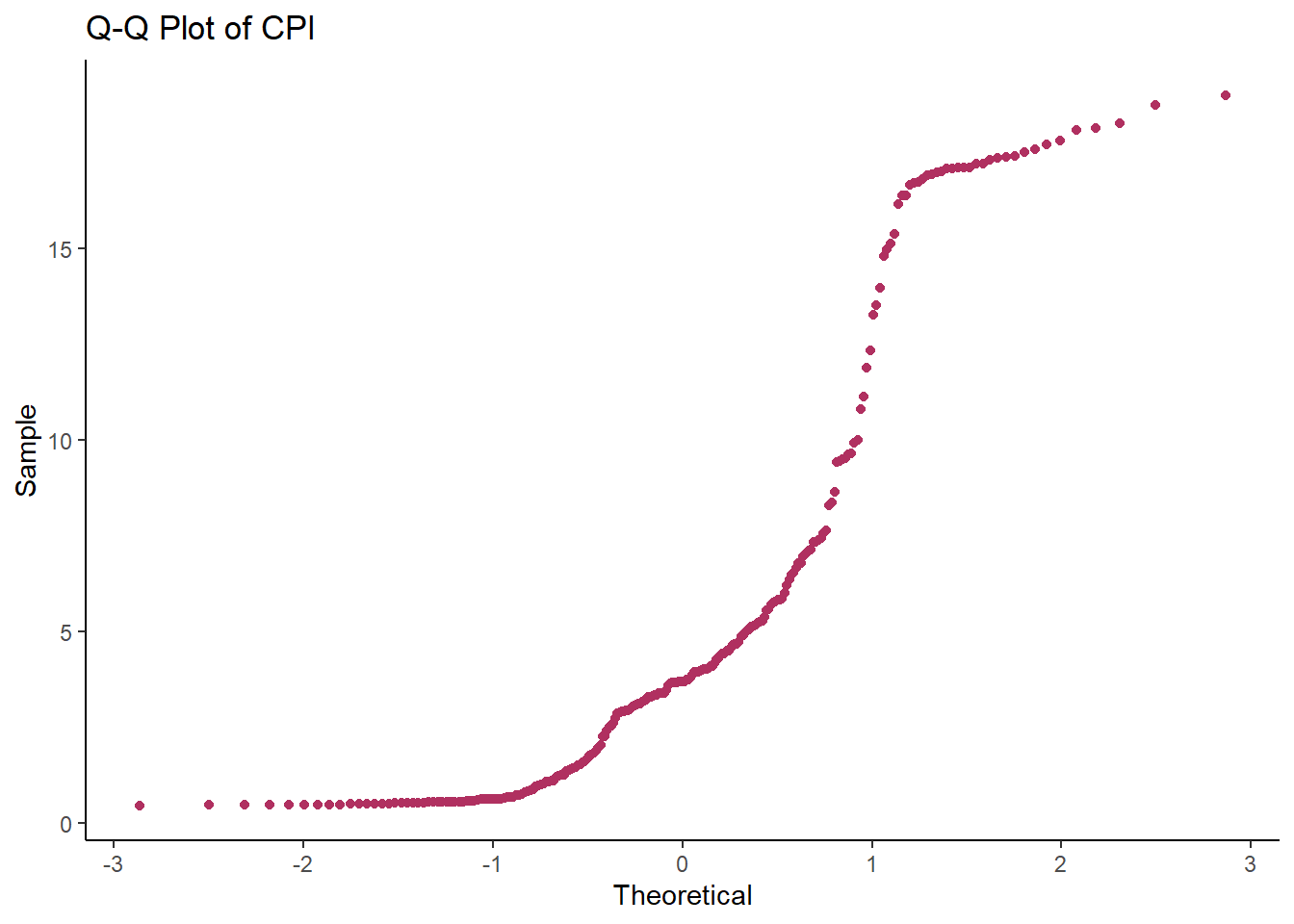

iii) Q-Q Plot

The plot below clearly illustrates how far the CPI is from the normal distribution. QQ Plots compare observed data to standardized theoretical normal data. The closeness of the plot to straight line indicates the closeness of the observed data to being normally distributed. For our case, the CPI deviates away at the tails to form an S-curve that defies normality.

ggplot(CPI_Data, aes(sample=CPI_Data))+

stat_qq(color = "maroon")+

labs(title = "Q-Q Plot of CPI",

x = "Theoretical",

y = "Sample")+

theme_classic()

8) Checking Normality Formally

i) Jarque Bera Test

CPI_Data %>% jarque.bera.test() # From package "tseries"

Jarque Bera Test

data: .

X-squared = 57.318, df = 2, p-value = 3.577e-13The hypothesis for this test is:-

Here, the p-value is smaller than 0.05 and thus we reject

9) Testing Stationarity Pictorially

a) Lagged Plots

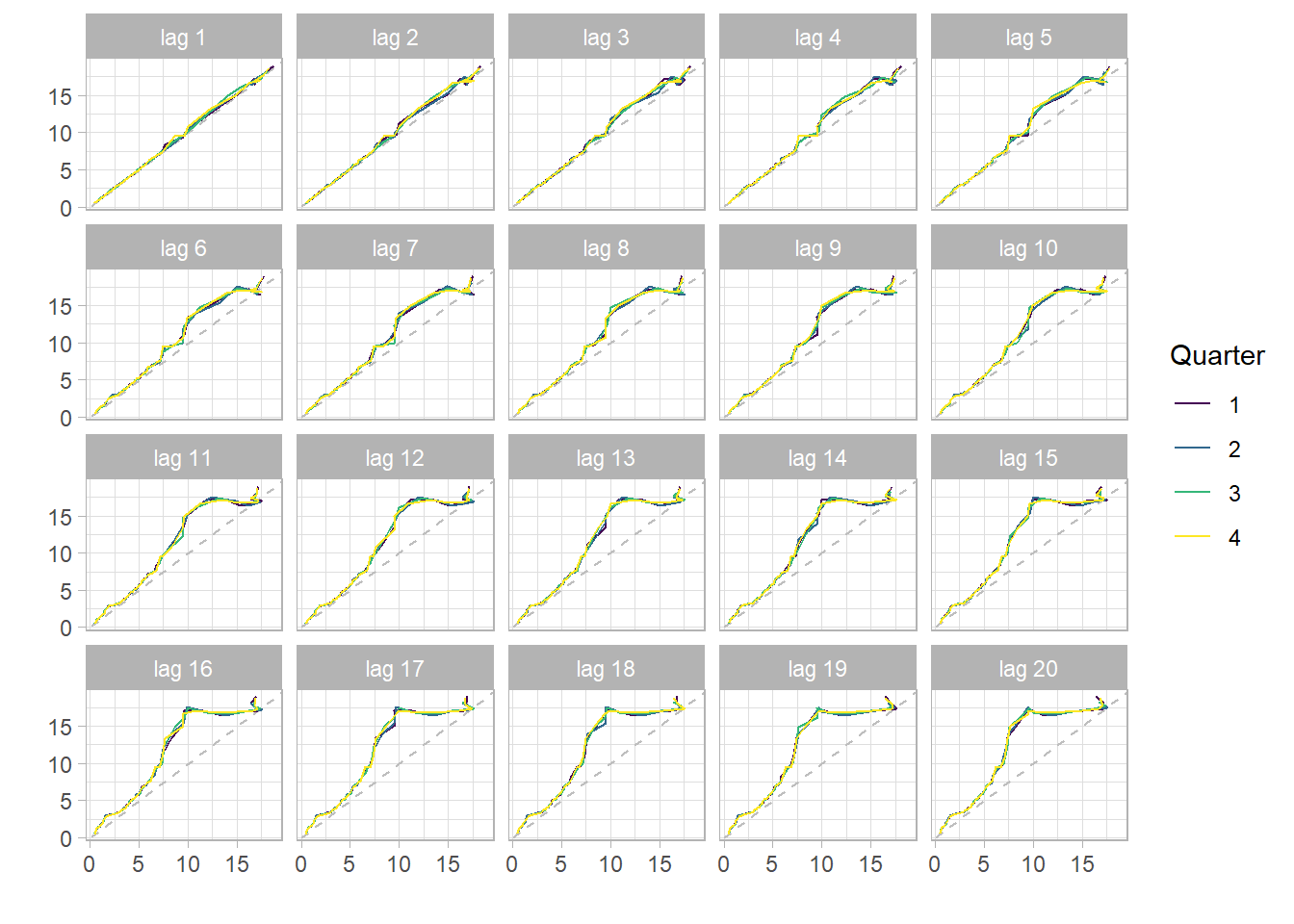

The figure below shows plots of lags 1 to 20. The fact that there is a strong persistence of a straight line (autocorrelation) for lags above 20 excludes the dominance of an MA(q) in the series and gives a strong evidence for an AR(p). This persistence is due to the strong correlation (0.987) at lag one. This property is also called long memory. However, the series cannot be simply an AR(p) since the order of such an AR(p) would be too large a number and parsimony (idea of Occult’s Razor) would be violated. Therefore, the lagged plots give evidence of an ARMA(p,q) being the underlying best-case scenario.

CPI_Data %>% gglagplot(lag = 20,

seasonal = TRUE) +

scale_color_viridis_d(option = "viridis") +

theme_light()

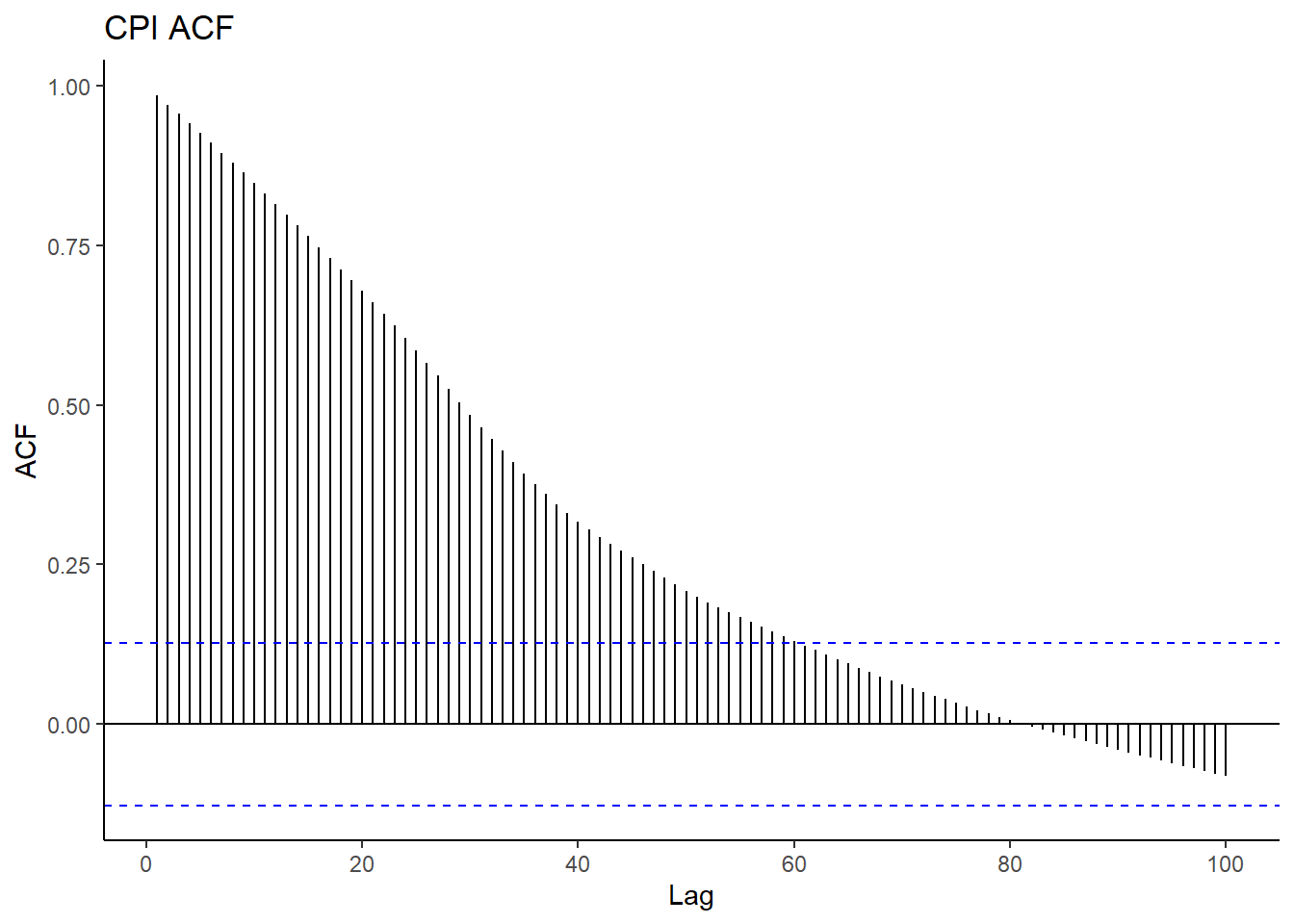

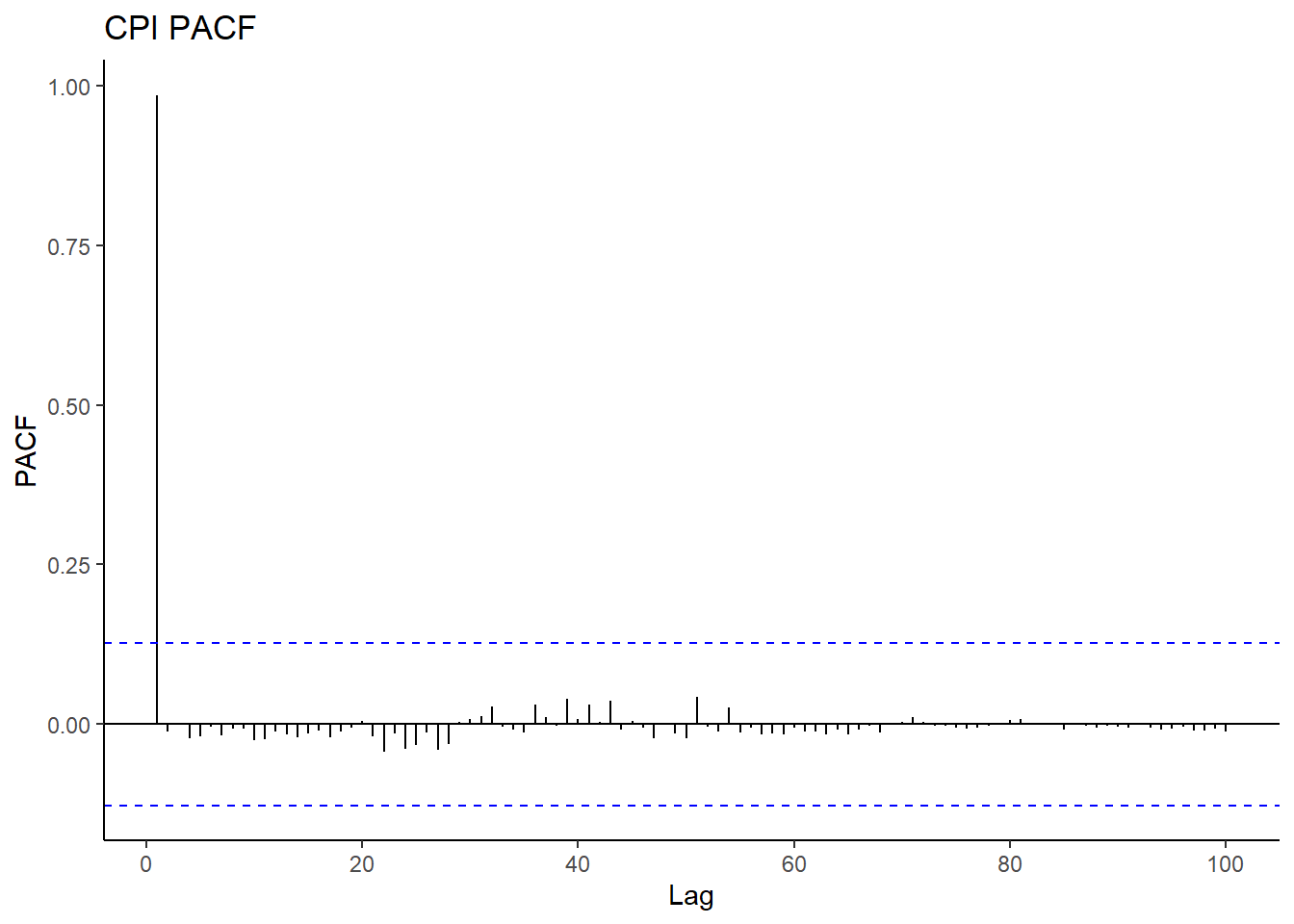

b) ACF and PACF

The figure below is a correlogram of ACF and ACF of CPI for the first 80 lags. The slowly decaying property in ACF further gives evidence of the series being non-stationary and hence an AR(p). Because of the trend, the observations will usually be on the same side of the series’ global mean. The terms

The PACF cuts off immediately after the associated lag. This is typical of non-stationary processes.

CPI_Data %>% ggAcf(lag.max = 100,

plot = TRUE) +

labs(title = "CPI ACF")+

theme_classic()

CPI_Data %>% ggPacf(lag.max = 100,

plot = TRUE) +

labs(title = "CPI PACF")+

theme_classic()

10) Testing Stationarity Formally

a) Augmented Dickey-Fuller Test (tests for unit root)

The Augmented Dickey-Fuller (ADF) Test has the following hypothesis:

adf.test(CPI_Data)

Augmented Dickey-Fuller Test

data: CPI_Data

Dickey-Fuller = -0.52375, Lag order = 6, p-value = 0.9802

alternative hypothesis: stationaryWe fail to reject 0.9802 > 0.05. The conclusion is that CPI for the period under study is not stationary. It follows from this conclusion that differencing is required to render the series stationary. As we have earlier deduced the underlying model to be ARMA(p,q), we now have a strong evidence for ARIMA (p,d,q) where d is the number of times required to difference to achieve stationarity.

b) Ljung-Box Text (tests for white noise)

Testing stationarity by checking whether the data is white noise, Ljung-Box (1978) test was made use of. The test is based on whether the sample autocorrelation is equal to zero:

This test follows a Chi-square distribution. If the p-value is less than 0.05 at lag

The test statistic is given as;

Box.test(CPI_Data, type = "Ljung-Box")

Box-Ljung test

data: CPI_Data

X-squared = 234.89, df = 1, p-value < 2.2e-16Clearly, the data is not white noise, we reject

11) Automatic Fitting of ARIMA(p,d,q)

Having established that CPI follows an ARIMA (p,d,q) model, we go ahead to find the best fitting model using AIC and BIC as the tools for choosing the parsimonious fit. The package forecast with appropriate dependencies installed, we are saved the trouble of transfoming the data to stabilize variance and seasonality before manually differencing.

CPIfit <- CPI_Data %>% auto.arima(approximation = FALSE,

stepwise = FALSE,

trace = FALSE) # trace = TRUE will print all the possible models

summary(CPIfit)Series: .

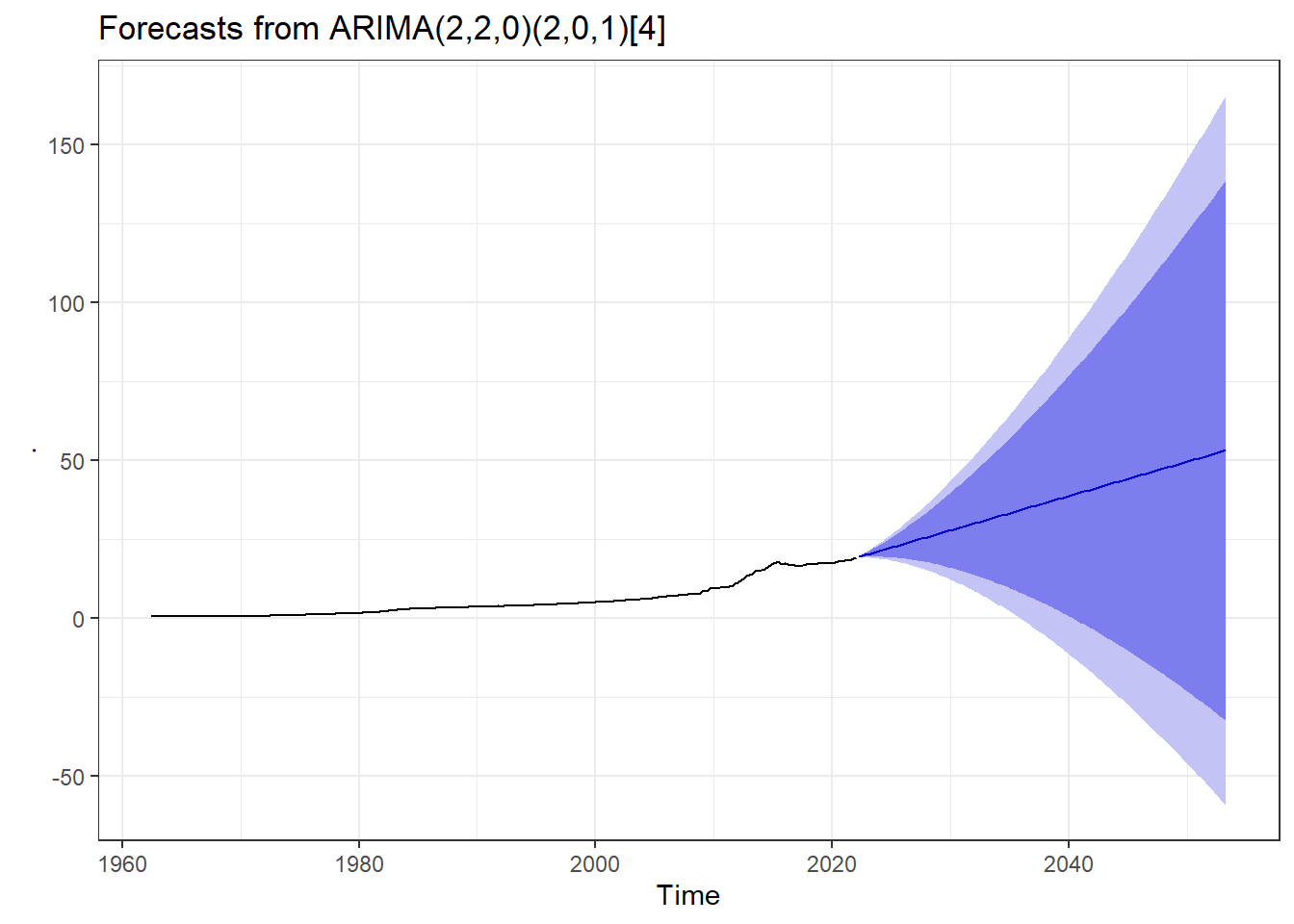

ARIMA(2,2,0)(2,0,1)[4]

Coefficients:

ar1 ar2 sar1 sar2 sma1

-0.7461 -0.4174 -0.8993 -0.2587 0.8043

s.e. 0.0610 0.0596 0.0983 0.0644 0.0831

sigma^2 = 0.01867: log likelihood = 137.05

AIC=-262.1 AICc=-261.74 BIC=-241.29

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.002888028 0.1346216 0.06989758 0.08317552 1.286139 0.2097828

ACF1

Training set -0.03239534Notice that by setting approximation = FALSE and stepwise = FALSE a more advanced/rigorous search for a model in conducted. The best model has the smallest BIC and AIC. The non-seasonal order (2,2,0) means the series has a moving average of order 0, an autoregressive component of order 2, and the ARMA is differenced twice (d = 2) to achieve stationarity. The mathematical model is the product of MA and AR components.

A pure AR(p) model is one where

A pure MA(q) is is one that

Overall, ARIMA becomes:

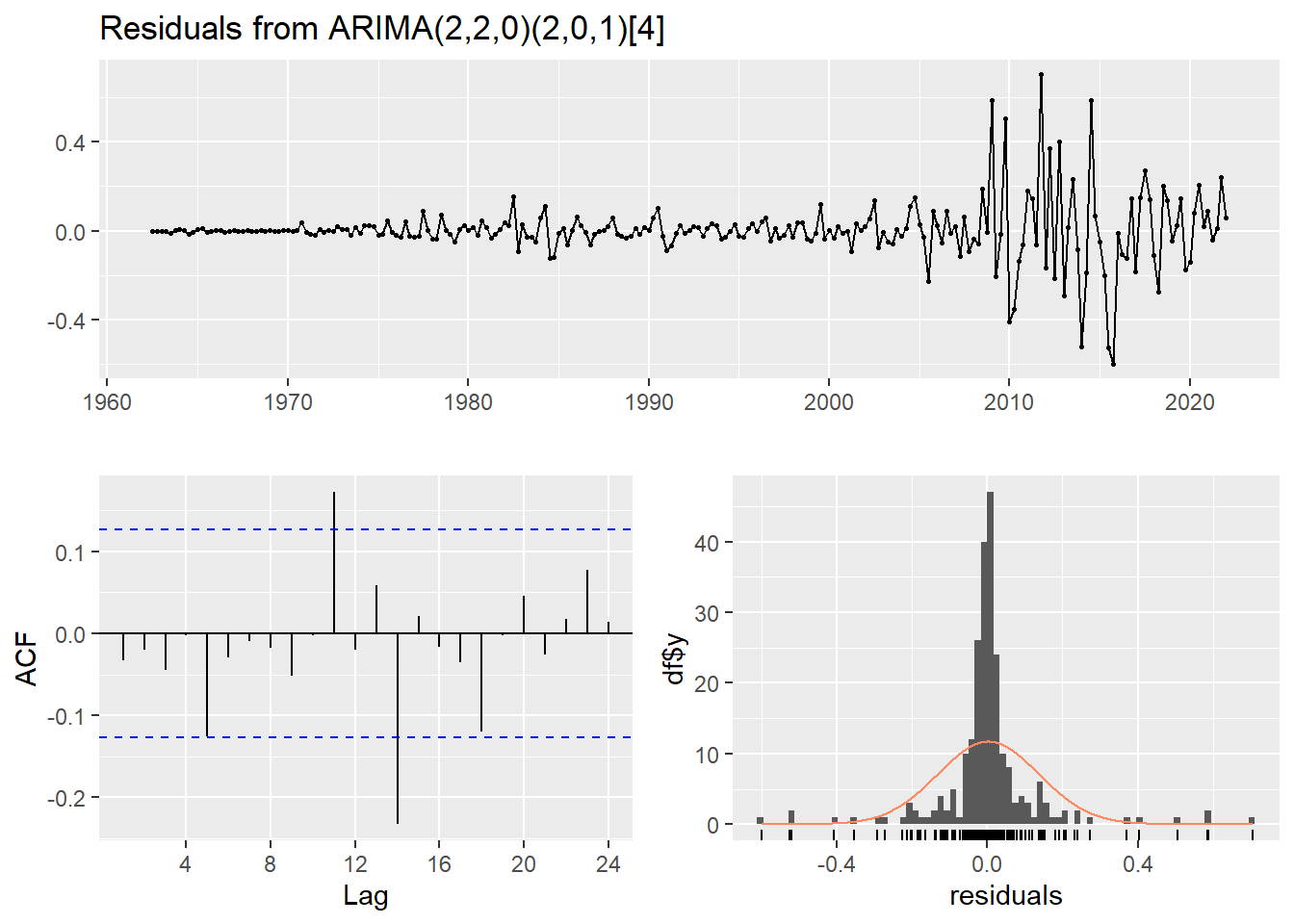

a) Check Residuals for White Noise

checkresiduals(CPIfit)

Ljung-Box test

data: Residuals from ARIMA(2,2,0)(2,0,1)[4]

Q* = 5.0548, df = 3, p-value = 0.1678

Model df: 5. Total lags used: 8There are a few significant spikes in the ACF, and the model fails the Ljung-Box test. The model can still be used for forecasting, but the prediction intervals may not be accurate due to the correlated residuals. Sometimes it is just not possible to find a model that passes all of the tests.

b) Forecasting

CPIforecast <- CPIfit %>%

forecast(h = 125, # Forecast 5 (each with 4 seasons) years ahead of Sept 2020

level = c(95, 99))

# summary(CPIforecast) # Print forecastsc) Visualising Forecasts

CPIforecast %>% autoplot() + theme_bw()

The point forcasts with both 95% CI and 99% CI are contained in summary(CPIforecast) for 33 years (each with 4 seasons) ahead of 2020, that is upto Q2 2053.

End

Note: This post was first published by the author on RPubs in 2019.